Join Our Telegram channel to stay up to date on breaking news coverage

The decentralised finance (DeFi) landscape is rapidly evolving beyond its initial speculative phase, increasingly focusing on bringing real-world assets (RWAs) and institutional capital on-chain. This critical shift drives significant innovation and market activity as protocols bridge the gap between traditional finance and the crypto economy through undercollateralised lending, compliant frameworks, and robust stablecoin systems.

In this transformed environment, we explore leading DeFi tokens demonstrating notable market momentum. From Maple Finance and Clearpool, pioneering institutional lending, to Vaulta, building a full-stack Web3 bank, and Sky, advancing stablecoin infrastructure, we delve into their recent performance, key developments, and what makes them pivotal players in the growing institutional adoption of decentralised finance.

Biggest DeFi Token By Market Activity Today – Top List

Maple Finance (SYRUP) is a decentralised credit platform offering undercollateralised loans to institutions. Clearpool (CPOOL) provides uncollateralised lending via permissionless credit markets. Vaulta (A) is an AI-driven wealth and asset management protocol for on-chain portfolios. Sky (SKY) is a decentralised AI agent network built for autonomous interactions and digital productivity. Let’s dive into why these tokens are among today’s leading DeFi tokens by market activity.

1. Maple Finance (SYRUP)

Maple Finance is a decentralised lending protocol. It focuses on institutional capital. It offers undercollateralised loans. Vetted pools and on-chain governance manage these. It connects real-world money (RWA) with DeFi. This allows institutions to borrow without overcollateralising. This is due to governance-driven credit review and insurance.

The protocol’s strength comes from growing support from institutional borrowers. It also benefits from better capital efficiency. As more creditworthy groups use Maple’s pools, SYRUP becomes both a reward and an ownership token. This links directly to more lending and revenue sharing. Its place in RWAs makes it one of the few DeFi tokens with real yield potential.

Maple (SYRUP) trades at $0.45. It gained 3.22% in 24 hours and 13% over the last week. It had 15 “green days” last month. It stays above its 200-day moving average of about $0.40. This shows trend strength. It also indicates growing confidence tied to its lending activity.

Maple Finance recently congratulated SparkFi on its launch. The team also shared a significant update: they’ve already allocated $325 million into their syrupUSDC product while celebrating the ongoing rollout of mSOL support for institutional borrowers.

This update, therefore, highlights Maple’s accelerating growth in deploying capital and deepening its Solana integrations. For investors, the swift allocation of over $325 million into syrupUSDC, coupled with the mSOL collateral push, clearly signals robust demand and institutional trust. These are compelling indicators that Maple is effectively scaling its reach and utility within DeFi.

2. Clearpool (CPOOL)

Clearpool operates as a permissionless DeFi lending platform. It offers undercollateralised loans backed by institutional-grade capital. Capital providers gain controlled exposure through risk tranches. Borrowers, such as market-making firms, can access loans without excessive collateral. The CPOOL token enables governance and accrues value on-chain from interest flows.

The token continues to benefit from rising demand as institutional DeFi use matures. Recent updates to fee-sharing and risk tranches are boosting capital efficiency and improving returns for lenders. CPOOL remains a direct reflection of real-world DeFi utility as adoption grows, not merely speculative momentum.

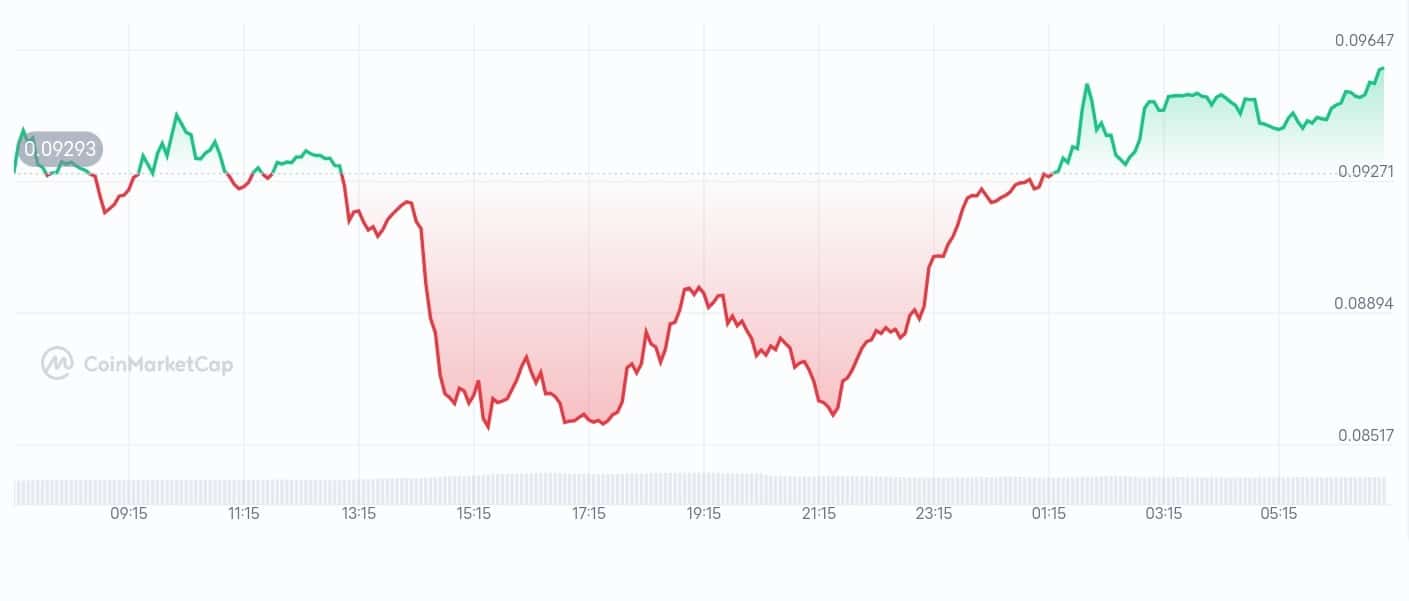

Clearpool (CPOOL) trades at $0.096507, showing a 5.3% gain in the last 24 hours and a 9% increase week-over-week. It recorded 9 “green days” in the past month. It sits above its 200-day Simple Moving Average (SMA) of approximately $0.095. This positioning signals that technical traders view the token as consolidating into a higher trading range.

The RWA opportunities on Ozean continue to expand!

Ozean is unlocking SME financing opportunities in Port via @defaprimitive

With 420M+ invoices tokenized, $70M+ of invoices factored, and only 0.2% in bad debt, DeFa will enable users in the Ozean ecosystem to earn stable… pic.twitter.com/jH420bPop8

— Clearpool (launching Ozean🌊) (@ClearpoolFin) June 17, 2025

Clearpool Finance, operating under the brand Ozean, recently shared significant milestones. They have successfully tokenised over 420 million invoices and factored over $70 million while maintaining a very low alarming debt rate of just 0.2%. Furthermore, they emphasised that users within the Ozean ecosystem can directly earn through this unique DeFi-for-Invoices model.

This achievement underscores Ozean’s growing traction in real-world asset finance. It demonstrates the delivery of tangible revenue opportunities combined with strong asset quality. For investors, this data points to a viable and scalable revenue engine managed with disciplined risk management. Consequently, this positions Ozean, and by extension Clearpool, as a compelling player within the RWA lending space.

3. SUBBD Token (ticker)

SUBBD is an AI-driven platform transforming content monetisation within the creator-subscriber space. It combines AI tools with Web3 technology, empowering creators to manage and monetise their content efficiently, bypassing intermediaries. Featuring AI live streams, voice generators, and a 24/7 personal assistant, SUBBD presents a decentralised alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.055725, having raised over $690,000, the token provides exclusive benefits, VIP access, and a 20% annual return through staking. A tenth of the total supply is designated for airdrops and rewards.

SUBBD has garnered attention on prominent cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, underscoring its growing presence in the AI and Web3 domains. The platform’s expanding influence is evident, with the launch of the AI Personal Assistant enhancing creator-fan engagement and support. As AI and Web3 reshape digital content, SUBBD is at the forefront of the future of creator earnings.

4. Vaulta (A)

Vaulta, formerly EOS, aims to be a full-stack Web3 bank. It offers DeFi tools like decentralised savings, yield strategies, payments, and tokenised assets. All of this is under a regulated, compliant system. With its exSat Bitcoin integration and partnerships, it blends CeFi ease with DeFi innovation. This gives users one-stop access to digital finance.

The rebranding to Vaulta sparked new interest. This is seen in rising Total Value Locked and institutional involvement. Its staking features, multi-signature governance, and consumer payment plans drive token demand. Its functions are built across financial systems. This makes it more than a narrative token. It has real-world use baked into its design.

Vaulta (A) trades at $0.4803. It rose 1.4% in 24 hours. It saw 10 “green days” last month. It is now trading near its cycle high. It is consolidating before becoming a wider adoption catalyst. Its price moved between $0.455073 and $0.482871 in the last 24 hours.

At @TheBitcoinConf 2025, we had the pleasure of announcing our strategic partnership with OKX @wallet.

Together, we're laying the foundation to scale Bitcoin DeFi to 50 million users.

"Giving access to a further 50 million users that they have, so that people will be able to… pic.twitter.com/oFDiuEUgL8

— Vaulta (prev. EOS) (@Vaulta_) June 19, 2025

Vaulta made a key announcement at The Bitcoin Conference 2025. They have formed a strategic partnership with OKX Wallet. OKX Wallet is now their official leading wallet partner. As one of the leading DeFi tokens, this collaboration enhances Vaulta’s wallet integration and user onboarding. It simplifies account creation and management for users within a top-tier wallet. For investors, this signals improved user experience, growing ecosystem integration, and more substantial support for mass adoption.

5. Sky (SKY)

Sky is a next-gen DeFi stablecoin system. It’s an evolved MakerDAO with a new SKY/USDS structure. It creates decentralised savings, governance, and stablecoin issuance. With USDS and dynamic savings rates, it offers non-custodial yields. The SKY token supports governance and stability.

The recent SPK token airdrop and governance changes have boosted the protocol. This resulted in better demand for SKY. Their new tokenomics, which include locked emissions and buybacks, build confidence in their long-term future.

Sky (SKY) trades at $0.07437. It gained 4.20% in 24 hours and 8.19% this month. It had 13 “green days” in June 2025. It stays above its 200-day moving average of about $0.07. This shows it is a stable momentum trade in DeFi. Its price moved between $0.068308 and $0.075362 in the last 24 hours.

YBS supply from the @SkyEcosystem has grown 2x since October.

In Oct Sky started migration from sDAI to sUSDS & their total capitalization was $1.45B. By February it reached an ATH of $4.15B.

During this period, sDAI supply dropped 50% with capital largely flowing into sUSDS. pic.twitter.com/1sGmqyogWe

— stablewatch (@stablewatchHQ) June 17, 2025

StableWatch recently highlighted a significant trend: SkyEcosystem’s YBS supply has doubled since October. This notable shift began as Sky migrated from sDAI to sUSDS, growing total capitalisation from $1.45 billion to an all-time high of $4.15 billion by February. During this period, sDAI supply notably dropped by 50% as capital flowed into sUSDS.

This fundamental shift underscores Sky’s growing dominance within the stablecoin sector and the clear trust users place in sUSDS. For investors, it signals strong user adoption and enhanced capital efficiency. Moreover, it demonstrates the network’s proven ability to pivot and scale, strengthening Sky’s position in the broader DeFi ecosystem.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage