Join Our Telegram channel to stay up to date on breaking news coverage

A new generation of tokens is taking center stage and changing the norms of cryptocurrency interaction. Across Web3, the most trending cryptocurrencies on Base Chain now are attracting attention and igniting communities, from creator-powered economies to AI-driven DeFi automation. In addition to becoming popular, Keeta, Zora, and Arcadia are changing perceptions.

The emergence of the “protocol economy” is still attracting interest. This new wave of innovation is changing how blockchains manage value and expand network effects, from tokenized infrastructure to token-powered incentives.

Most Trending Cryptocurrencies on Base Chain Now

Have you ever wondered what happens when decentralized innovation and high-speed compliance collide? Keeta responds with a protocol designed for practical financial situations. Wondering how an artwork or tweet becomes a liquid asset? Zora is allowing material to be traded. Furthermore, Arcadia is simplifying intricate DeFi moves to the level of an autopilot if yield tactics seem like a hard subject.

1. Keeta (KTA)

Keeta’s compliance-first strategy sets it apart. By directly integrating KYC/AML and tokenization into the blockchain protocol, issuers can incorporate rule engines, whitelists, identity checks, and even on-chain credential verification using X.509 certificates, all of which are instantaneously recognized across the network. This makes it possible to tokenize real-world assets and create regulated financial products on-chain without compromising trust.

In collaboration with the US credit data supplier SOLO, Keeta launched PASS, the first on-chain credit bureau, on June 5. By providing certified income, asset, and KYC/KYB data on-chain as reusable identity certificates, PASS allows DeFi users to quickly and legally get loans and mortgages based on actual creditworthiness rather than merely cryptocurrency collateral. This initiative represents a paradigm change, transforming institutional-grade lending into a programmable ecosystem and connecting DeFi and TradFi with genuine identification.

March 2025

∙ Keeta came out of stealth with the launch of $KTA

∙ Test network releasedApril 2025

∙ Partnership with FootPrint announced as the first KYC provider on Keeta NetworkMay 2025

∙ Revamped test network wallet and explorer

∙ Stress test planning, partnership…— Keeta (@KeetaNetwork) June 20, 2025

KTA has rebounded from its June 9 all-time high of $1.68, presently roughly 63% below that record, and has increased between 17 and 18% over the past day, indicating both renewed confidence and heightened volatility in the short term. Looking more closely at the pattern, this latest rise fits within a bigger story: KTA collapsed below $0.007 in early March, then surged by around 8,700%, retraced, and is currently stabilizing at $0.60. It appears that traders are locking in profits and reevaluating value.

With the support of well-known brands and infrastructure, it addresses pressing issues, including enterprise-grade subnetworks, on-chain credit linked to genuine financial identities, and quick, inexpensive, and regulated asset transfers. If PASS performs as expected and the network grows as anticipated, Keeta may be the first blockchain to truly blur the distinction between TradFi and DeFi.

2. Zora (ZORA)

Zora was created in response to a noticeable social media gap: content providers’ incapacity to fully control and profit from their work. By essentially turning every social media post into a marketable token, Zora unifies ownership and content on the blockchain. This implies that each thread, picture, or video has the potential to provide actual market value, enabling artists to receive prompt, clear, and direct compensation.

With no middlemen taking a cut, Zora provides a direct path from content to remuneration for creators confronted with opaque ad revenue structures or platform lock-in. Every post has the potential to be valuable, and every value creator’s creation can be traded. There was a significant discrepancy between the token’s value and the underlying platform, as evidenced by the ZORA token’s implosion, which saw it lose more than half of its value within days of inception, as reported by DeFiMarkets media around a week ago. This gap raised serious concerns about insider benefits and fairness, particularly when insiders had large allocations and started before formal announcements were made.

Your posts are valuable, now your profile is too.

Creator Coins are now on Zora. pic.twitter.com/yrXNYV6r7f

— $zora (@zora) June 20, 2025

As the network gradually unlocks key tokens, we observe that there are currently about 3.15 billion ZORA in circulation, or slightly more than 31% of the 10 billion maximum supply. Smaller monthly vesting events will continue throughout early 2026, with a big 1 billion ZORA unlock planned for late October 2025. Participants must be aware of this impending dilution, but the lockup structure allows for slow inflation, allowing the project to expand without experiencing excessive price pressure.

Zora has recently rewritten the creator’s economic blueprint. Two days ago, Zora launched a revolutionary token system that turns everything into tradable cryptocurrency assets, including posts, creators, and the entire social graph. This mechanism, which is called $POST and $CREATOR tokens, gives artists direct control over their finances by tokenizing a tweet or piece of art and allowing a worldwide audience to support or invest in it.

3. Arcadia (AAA)

Arcadia’s usage of user-owned smart contracts, or Arcadia DeFi Accounts, distinguishes it. In addition to being wallets, these also manage cross-protocol strategies, carry out batch transactions, and enable users to access sophisticated farming techniques without knowing how to code. The AAA token’s governance opens up significant features, such as increasing rewards through liquidity bribery, participating in protocol choices, and gaining access to unique tools like yield zaps and single-click leverage. This obvious incentive alignment turns passive LPs into active protocol builders, with users earning more as they vote and stake.

Only two weeks ago, it was listed on Gate’s Alpha platform, putting it in front of users looking for simplicity similar to CeFi with DeFi yields. This release comes from widespread attention as one of the most trending cryptocurrencies on Base Chain, highlighting its yield magic and its recovery from the hack last year. The team promoted several audits and reinforced guardrails around vault contacts, changing the narrative from “exploit survivor” to “resilience rebuilder.”

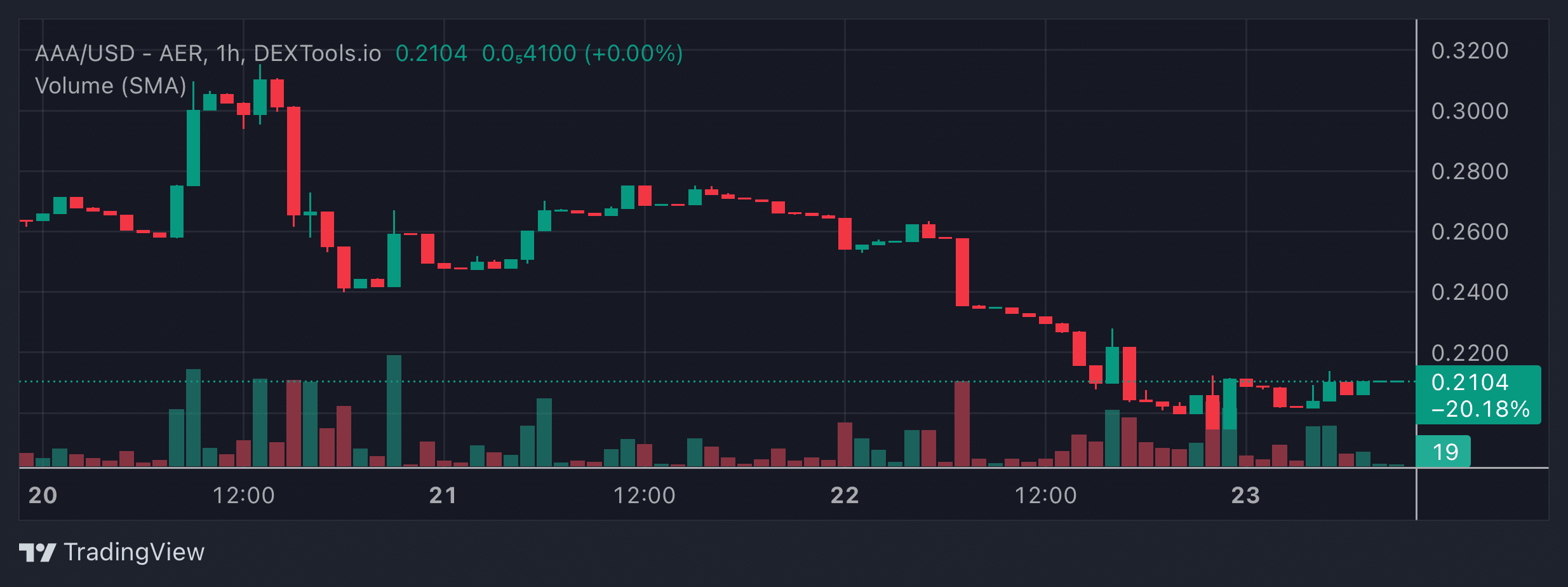

On a larger scale, Arcadia is up significantly from previous lows but still well behind its all-time high, which was over $1.05 in early June. This provides an interesting comparison. If all 100 million tokens are issued, the fully diluted valuation would be approximately $26 million, meaning that the current market cap represents just 10–12% of the long-term potential.

With its most recent invention, Asset Managers v2, which launches this week, Arcadia has been on a roll. This version introduces Strategy Hooks, which are modular, lightning-fast, and designed for quick yield innovation across Base and changing DEX ecosystems. Thanks to this update, Arcadia vaults are now plug-and-play incubators, letting developers create unique techniques that instantly maximize returns. The yield engineering field is gradually transitioning from static, stale vaults to a dynamic, decomposable environment.

What Might Be The Next Top Trending Crypto?

Snorter Token has brought a quick rush of enthusiasm to the cryptocurrency world, and if you’re looking to get an early-mover advantage, you should jump on it. A trading bot powered by Solana and encased in a Telegram UI, Snorter is not your typical meme token. It combines staking, anti-scam shielding, and high-speed sniping before reaching a public exchange. As a result of this practical advantage, its presale has already surpassed $1 million, enticing traders and meme enthusiasts to join the craze.

Early stakers can earn amazing APYs that range from 270% to 1,700%, depending on the stage, while SNORT is providing tokens at a tempting discount; currently, they are at $0.095. Its Telegram bot, in the meantime, allows users to make limit orders or replicate profitable traders without ever leaving their group conversation, performs lightning-fast swaps with MEV protection, and detects honeypots and rug pulls before they snare traders.

Why should investors give it any notice? This isn’t just viral or vaporware; it combines fundamental tools with community-driven momentum. Although meme tokens have a whimsical charm, they are encased in practical features that traders genuinely require, such as sniping, trading, and staking. And it’s both exciting and strategic to get that combo early during the presale.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage